Tax Time: Setting You Up for Success

Tax Time can be hectic, confusing, and stressful. Let us take some of the guesswork out of the process.

Disclaimer: This article is not meant to serve as tax advice. Please consult a tax professional if you have questions.

Tax Documents

One of the most frequent questions we receive from members is accessing tax documents and 1099s. You will only receive a 1099-INT from Christian Financial if your total combined interest earned from all of your accounts is more than $10. Otherwise, you will not receive a 1099-INT.

You will receive a 1099-R if you took a withdrawal from your IRA, and if you have a Save to Win account, you will receive a 1099-MISC if you won more than $600 in prizes.

If you have a Home Equity Line of Credit with Christian Financial, you will receive a 1098 for Mortgage Interest paid during the year from us. Our partner, Mortgage Center, will also issue a 1098 separately.

How do I know if I will receive a 1099-INT from Christian Financial?

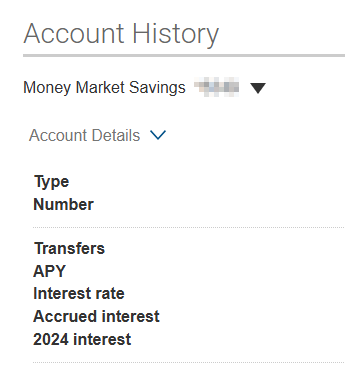

From Digital Banking – Online or Mobile Banking – navigate to your savings account. Under “Account History,” you will see “Account Details.” Expand Account Details (or “Show Details” in the Mobile App). From here you will see a field called “2024 Interest” or “Prior Year Interest” in the mobile app. If this is more than $10, you should receive a 1099-INT from Christian Financial.

If you have more than one savings account, you will need to add up the 2024 interest earned. If the total is more than $10, you will also receive a 1099-INT. You can also view your year-to-date interest earned on your E-Statements in Digital Banking.

Accessing Tax Documents

If you have E-Statements with Christian Financial, you can review your tax documents in Digital Banking by logging in and selecting Statements, then My E-Statements/Notices/Tax Forms. A new window will load, and you can print them from there. These are also available in our Mobile App as well.

Member Benefits

As a Christian Financial member, you are eligible for exclusive discounts with Love My Credit Union Rewards and TurboTax. Members can save up to $15 on TurboTax federal products.

If you need a little more help, Love My Credit Union Rewards and H&R Block also offers Christian Financial members $25 in savings on in-office tax prep services for new clients and returning clients receive the Tax Identity Shield add-on for FREE ($35 value).

Tax Time can be overwhelming, but Christian Financial’s digital resources can help answer your questions and help you feel prepared to tackle your taxes.